In this article you’ll learn…

How to make a marketing impact at Singles' Day

Double Eleven (also known as Singles' Day) has become the biggest shopping festival in the world, with sales now overshadowing Black Friday and Cyber Monday combined.

So, what exactly is Double Eleven? And why are Double Eleven campaigns so crucial for China marketing?

For luxury brands especially, navigating a day of discounts takes the right approach in order to maintain exclusivity, while still taking advantage of the mass drive to buy.

That’s why, in this post, we’ll take you through what Fashion, Luxury and Beauty (FLB) brands need to know about Double Eleven.

What is Double Eleven in China?

Double Eleven (or Double 11) is a massive shopping festival that takes place annually in China. Singles’ Day itself is on November 11, but the festival takes place over the course of a few weeks, with promotions and pre-sales dominating the digital landscape from October.

Singles’ Day started as a 24-hour shopping spree back in 2009 – an initiative of Chinese e-commerce giant, Alibaba. Since then, it has grown steadily year-on-year. To understand how ingrained it has become in Chinese popular culture, consider that each event is now kicked off by a massive, star-studded Countdown Gala. For example, in 2019, Taylor Swift headlined the event, which was followed by a record-breaking US $1.43 billion in sales for Alibaba in the first 96 seconds alone.

With so much buzz around the festival, it’s obvious why FLB brands are keen to take part.

Double Eleven by the numbers

Here are some key figures on Double Eleven:

- In the first two weeks of November 2021, shoppers spent roughly $132.6bn between the two largest Singles' Day retailers, Alibaba and JD.com.

- 290,000 brands offered deals and 900 million Chinese consumers shopped the Singles’ Day sales in 2021.

- Participation from luxury brands is growing. Last year, more than 200 brands took part via the Tmall Luxury Pavilion, Alibaba’s platform for high-end brands.

- This year, 21 million products were offered to over one billion Chinese shoppers.

Why is Double Eleven so important for FLB brands?

There's no doubt that Double Eleven is the most important shopping day in China. For fashion, luxury and beauty brands looking to break into the Chinese market, sitting it out is a missed opportunity that will leave them lagging behind the competition.

Beauty is one fast-growing category for Singles’ Day sales. Last year, 265 beauty brands on JD.com reportedly saw their contract value increase more than tenfold compared to 2020. In fact, 2021 pre-sale stats showed that beauty products accounted for 91% of live-streaming sales.

While standing out amidst the barrage of competing brand messages may be a challenge, it’s one worth tackling if you want a piece of the Singles’ Day pie.

Four tips to Singles’ Day success

Here are some key points to keep in mind when devising your China marketing strategy for Double 11.

1. Use social media to drive direct sales

At least 90% of all Double Eleven transactions are made on mobile devices, and it’s not just eCommerce stores: social commerce is taking an increasing share of the sales.

Platforms such as Douyin, Xiaohongshu and WeChat that allow brands to set up storefronts are now a crucial piece of the puzzle. As well as generating buzz and creating awareness, FLB brands can and should be using social media platforms to directly drive sales.

Format-wise, livestreams and short-format videos have become key to engaging with younger audiences on social media.

2. Start promotions early

For successful Double Eleven campaigns, it’s important to lay the groundwork early. As early as September, companies start ramping up their brand awareness efforts across various channels - before the first wave of pre-sales hits in October.

Plan your content strategy ahead of time and book your Key Opinion Leader (KOL) partnerships early so that your livestreams are scheduled and ready. By doing this, you’ll build lasting engagement with customers instead of relying on their impulse purchases.

3. Leverage KOL partnerships

KOLs have become a key ingredient to China marketing campaigns. They hold tremendous power when it comes to directing consumer purchasing decisions on Singles’ Day, often introducing their fans to dozens – if not hundreds – of products via livestreams.

Take 'Lipstick King' Austin Li, for example. On the first day of pre-sales, leading up to the 2021 Singles’ Day event, the beauty influencer sold a whopping $1.9bn in product – all during one marathon broadcast.

Consumers trust in KOLs. In a 2022 survey of female Chinese consumers, KOL collaborations were ranked the number one promotion tactic, followed by livestreams and Key Opinion Customers (KOC) collaborations.

It’s important for brands to define clear goals between their KOL and KOC collaborations. A brand’s own livestream can be used to target consumers who are already interested in their products, while KOL livestreams can target new customers from that influencer’s fan base.

If you're not up to date on all things KOL and Chinese social platforms, read our blog on the power of Douyin and strategic voice partnerships.

Case study: Sisley

Sisleys’ campaign for their L'Integral Anti-Age Cream centered around the disadvantages of staying up late. To spread this message, the brand used KOLs to promote the product’s anti-ageing effects. This exposure netted the brand ¥4.7m in Media Impact Value™ (MIV®).

Top-tier KOLs accounted for 73% of the gained value (¥3.3m in MIV®), once again proving how valuable these influencer partnerships can be.

Douyin was Sisley’s highest-performing platform, accounting for ¥2.3m in MIV®.

4. Keep abreast of new trends – like the Metaverse

The Metaverse has already embedded itself into Double Eleven in many ways. eCommerce sites have created virtual worlds with 3D products, used virtual influencers to promote products, and hosted art exhibitions where customers can shop for luxury-branded NFTs.

Clinique claims the Media Impact Value™ throne

A crucial step in any marketing campaign is tracking and measuring performance during and after the campaign period - the best Chinese marketing strategies are no different.

This process allows you to understand how your brand message is being received, which channels are giving you the best ROI, and who your best brand advocates are.

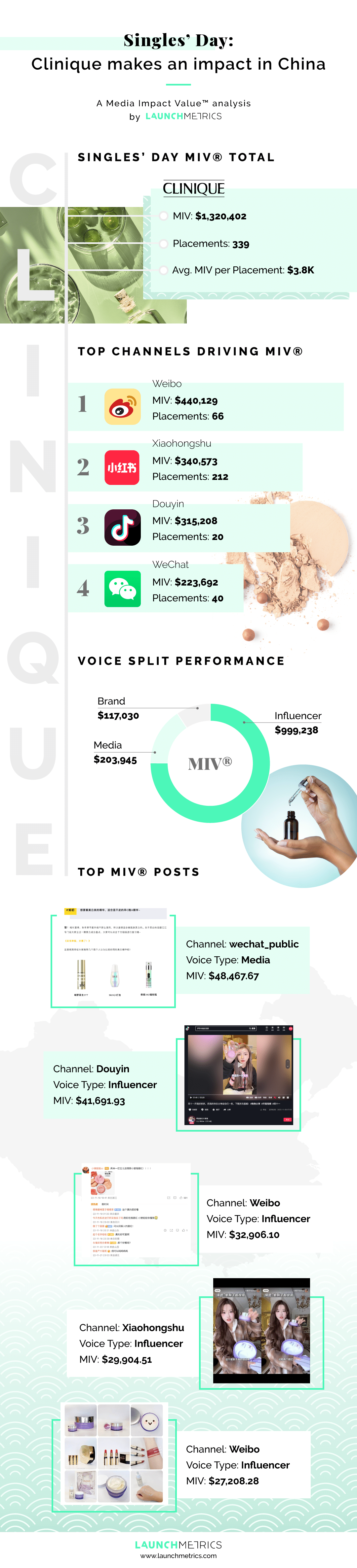

Our team of data experts have used our technology, to track Clinique's marketing strategy throughout Double Eleven. We found that, this year, the beauty brand achieved an eye-watering $1.3m in MIV®.

This figure culminated from a mix of strategic Voice partnerships, with messaging being vocalised and spread across a variety of social platforms. We were able to hone in on the following specific data with the click of a button using our easy-access tool. Scroll down to see how Launchmetrics Insights deciphered the components that made up this impressive campaign.

This further proves that, with the right data in hand, you can optimize your campaigns to maximize performance year on year. You can be sure that Clinique will be using the success of Singles' Day to better allocate their marketing spend at 2023's event.

The devil is always in the detail, and our tools allow brands to highlight data that's tailored to their unique tone and niche landscape, while enabling them to track performance against their competitors.

Launchmetrics Insights is industry-specific to fashion, luxury and beauty and, as you can see from our handy infographic, it includes tracking of Chinese platforms like Douyin, WeChat, Weibo and more.

Wouldn't you like to track how much ROI each individual online mention is bringing your business? It's time to truly enhance your campaigns and streamline your processes. Find out more about Launchmetrics Insights here or contact our team today.